haven't filed taxes in 10 years canada

If you dont file a tax return you will be in violation of the law. If you earned this money while out of the country for greater than 2 years you are not required to file a return on it.

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

What happens if you havent filed taxes in 10 years canada Tuesday May 24 2022 Edit If you fail to.

. Havent filed taxes in 10 years canada Monday February 14 2022 Edit. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month.

A taxpayer has 10 years from the end of the year in which they. Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips. Ask a Canada Law Question Get an.

Penalties include up to one year in prison for each. Havent Filed Taxes in 10 Years If You Are Due a Refund. Havent filed taxes in 10 years canada.

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. Filing taxes late in canada. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more.

Unfiled Taxes What If. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. Get all your T-slips and what ever.

Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month. Havent filed taxes in 10 years canada Friday May 6 2022 You owe fees on the unpaid portion of your tax bill.

If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. What happens if you havent filed taxes in 10 years Canada. Further the CRA does not go back greater than 7 years.

We can help Call Toll-Free. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure. 4000 fine for failing to file personal and corporate tax returns.

Have you been contacted by or acted upon Canada. Start with the 2018 one and then go back to 2009 and work your way back. If you go to genutax httpsgenutaxca you can file previous years tax returns.

What happens if you havent filed taxes in 10 years in Canada. Havent filed taxes in 10 years canada Monday February 14 2022 Edit. What happens if you havent filed taxes for several years.

Filing Taxes Late In Canada.

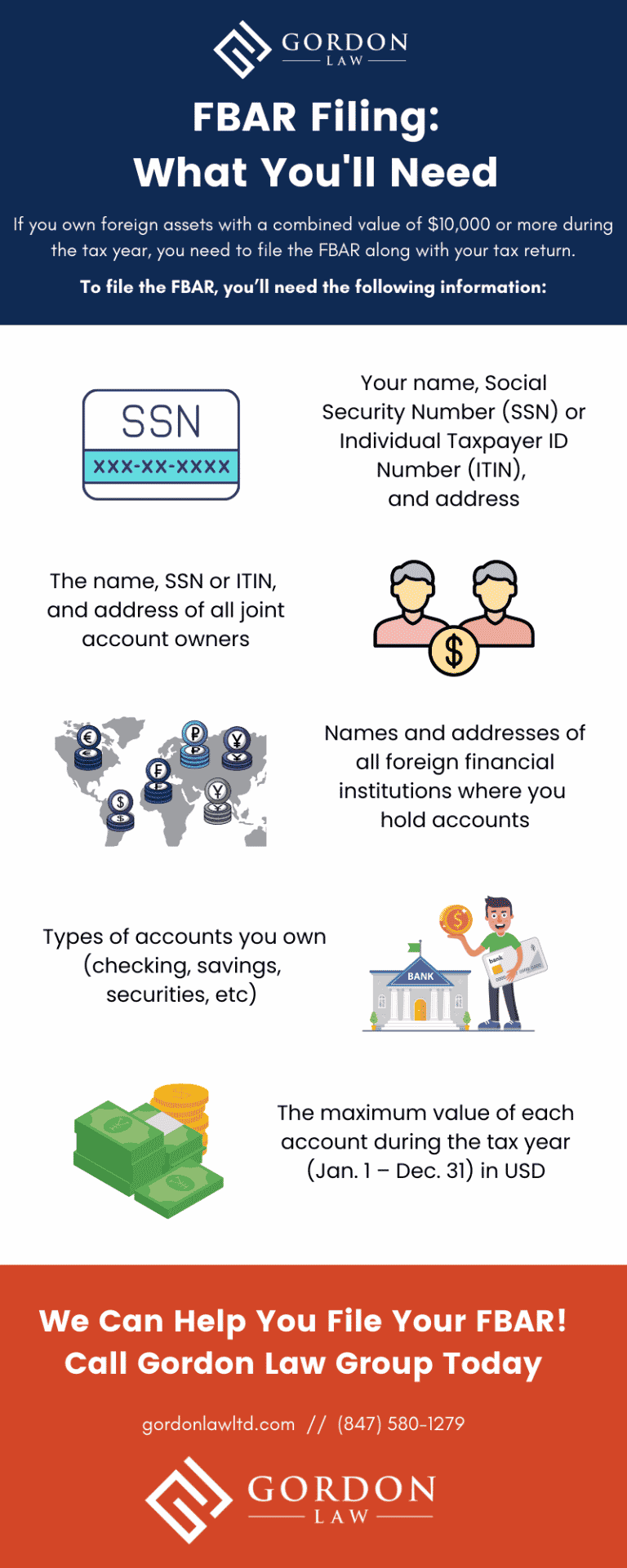

The Fbar Who Should File And What Happens If You Don T

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Haven T Filed Taxes In Years What You Should Do Youtube

Tax Day 2022 10 Tax Changes That Could Impact The Size Of Your Refund Cnet

10 Tax Filing Myths That Could Cost You Money Cbc News

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

What Do Do If You Still Haven T Received Your Tax Refund Tom S Guide

Taxes For Expats Filing And Preparation Expat Tax Online

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

The Fbar Who Should File And What Happens If You Don T

Where S My Refund Tax Refund Tracking Guide From Turbotax

The Key Issues When Filing A Person S Final Tax Return Wealth Professional

2 Million Canadians Who Haven T Yet Filed Taxes Could Face Benefits Interruption Cra Warns National Globalnews Ca

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How To File Us Tax Returns In Canada Ultimate Guide

What Should You Do If You Haven T Filed Taxes In Years Bc Tax